- Home

- Philosophies

- Our Market

North American

- Trade Show & Exhibition Industry

Asian

- Trade Show & Exhibition Industry

- Our Services

Customized Research

- Breadth of Research

- Depth of Research

Specialized Marketing & Sales

- Industry Specialists

- Marketing & Sales Specialists

Tailored Exhibits Services

- Pre, At, Post Show Services

- Creative & Custom Design

- Logistics and Services

- Evaluations and Leads Management

Trade Related Services

- Bilateral Import/Export Consulting

- Industry Trade Missions

- Associations

- Contact Us

Trends

We make trends work in your favor.

Current and Past Conditions

Click on the Image to Enlarge

Click on the Image to Enlarge

In 2008, the exhibition industry experienced its first decline since 2002, decreasing 3.1% versus 2007, according to The CEIR Index. Over the same period, the growth rate for real Gross Domestic Product (GDP) was 1.1%. Despite the growth in GDP last year, most economists have stated that the U.S. has been in a recession since December 2007, and in fact, GDP shrank 0.2% in the fourth quarter of 2007.

During the first quarter of 2008, GDP grew 0.9%, but the second quarter of 2008 was the last for GDP growth, at a rate of 2.8%. Second quarter GDP was helped by the $168 billion federal tax rebate, which spurred consumer spending and drove economic growth. GDP receded 0.5% in the third quarter of 2008 and then declined sharply in the fourth quarter, by 6.2%.

The 2008 quarterly results for the overall exhibition industry reflected the pattern of GDP, as the industry grew 0.5% in the first quarter of the year, was flat in the second quarter, and then declined in the third and fourth quarters at rates of 6.0% and 5.7% respectively. In fact, all four key industry metrics declined in the third and fourth quarters of 2008, as compared to 2007.

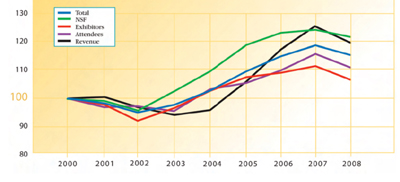

The following graph shows the CEIR Index metrics for the overall exhibition industry from 2000 to 2008

Click on the Image to Enlarge

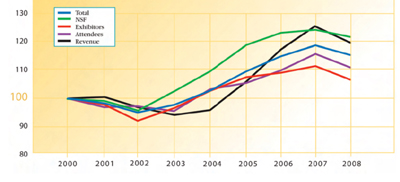

The following shows the year to year changes of the overall exhibition industry between 2000 to 2008 as measured by the CIER index.

Click on the Image to Enlarge

Net Square Feet (NSF)

- 2000-2008: NSF for the overall exhibition industry increased at a Compound Annual Growth Rate (CAGR) of 2.4% from 2000 to 2008, led by 3.9% CAGR increases in the Medical and Health Care and Government sectors.

- 2007-2008: NSF had increased each year since 2002 before declining 2.0% in 2008, led by sharp decreases in the Consumer Goods, Building and Construction, and Transportation sectors.

Exhibitors

- 2000-2008: The number of exhibitors for the overall exhibition industry increased at a CAGR of 0.9% from 2000 to 2008. The Consumer Goods sector fell by a 3.0% CAGR over the period, but this decline was offset by 3.2% CAGR increases in both the Medical and Health Care and Transportation sectors.

- 2007-2008: After hitting a bottom of 92.7 in 2002, exhibitors increased each year through 2007. In 2008, however, exhibitors experienced at 2.6% decline, as Consumer Goods and Building and Construction each fell 8.4% for the year. Additionally, exhibitors for Professional Business Services declined 6.4% in 2008.

Attendees

- 2000-2008: The number of attendees for the overall exhibition industry increased at a CAGR of 1.3% from 2000 to 2008, led by a 5.7% CAGR gain in Sports and Travel and a 5.0% CAGR increase in the Industrial market.

- 2007-2008:The number of attendees for the overall exhibition industry declined 4.0% in 2008 versus 2007, after increasing each year since 2004. Attendance for the overall industry was pulled down by sharp declines in the Government and Building and Construction sectors of 13.2% and 12.8% respectively, even though attendance for the Information Technology sector increased 10.4% for the year.

Revenue

- 2000-2008: Revenue for the overall exhibition industry grew at a CAGR of 2.3% from 2000 to 2008, led by a 5.7% CAGR increase in Transportation, along with strong gains in Consumer Goods and Building and Construction.

- 2007-2008: Revenue for the overall exhibition industry declined 3.5% in 2008, as revenue for the Building and Construction and Consumer Goods sectors declined 11.8% and 9.0% for the year, respectively. The Information Technology sector posted a positive gain in revenue of 14.7% in 2008.

With the 2008 year-over-year contraction of the exhibition industry linked to the recessionary economy, all indications point to continued declines for the industry in 2009, as the economy is not expected to recover until the second half of 2009 or first quarter of 2010. The National Association for Business Economics, a panel of 47 leading economists, has predicted recently that the U.S. economy will not recover until the second half of 2009 at the earliest. Further, the panel went on to predict that GDP would decrease at annualized rates of 5.0% and 1.7% in the first and second quarters of 2009 respectively. The panel predicted that GDP would begin to grow again in the second half of 2009 at an annualized rate of 1.6%. Overall, their forecast was for GDP to decline 0.9% for the year.

About CEIR

CEIR serves to advance the growth, awareness and value of exhibitions and other

face-to-face marketing events by producing and delivering research-based

knowledge tools that enable stakeholder organizations to enhance their ability

to meet current and emerging customer needs, improve their business performance

and strengthen their competitive position. For additional information, visit

www.ceir.org.

About JEGI

JEGI, the leading M&A advisor serving the event industry, has completed more

transactions in this sector than any other advisory firm. JEGI has represented a

wide array of clients, including global media companies, private equity firms,

associations, and entrepreneurial owners, in transactions involving the sale of

B2B and B2C conferences and exhibitions and association shows.

JEGI is active in supporting the event industry through its involvement with the leading associations, research organizations and projects, such as the CEIR Exhibition Industry Index, the SISO Tradeshow Web Site Project, and the Annual Exhibition and Conference Industry Outlook, among others.

For more information, contact Managing Director Richard Mead ([email protected]) or Vice President Adam Gross ([email protected]), both at 212-754-0710, or visit JEGI’s web site at www.jegi.com.

- Our Markets

- North American

- Asia

- Contact Us

-

North America

General Inquiries: [email protected]

General: 1-403-451-5568

- Head Office

208, 212 - 7th Ave. SW

Calgary, Alberta

Canada T2P 0W6